Home

Products recommended for you

Home

Loans

Car

Loans

Credit

Cards

Personal

Loans

Membership Rewards Program

The merchants represented are not sponsors of Polam FCU or otherwise affiliated with Polam FCU. The logos and other identifying marks attached are trademarks of and owned by each represented company and/or its affiliates. Please visit each company’s website for additional terms and conditions.

Today’s Rates

| 30 Year Adjustable Rate | from 6.50% *APR |

| 5 Year Fixed Rate | from 7.50% *APR |

| Savings | 0.65% **APY |

| 12 month CD1 | 2.25% **APY |

| 24 month CD1 | 2.75% **APY |

– For other terms and conditions please refer to product information page.

1Minimum opening balance: $5,000.00

| New Auto Up to 84 months | 6.25% *APR |

| Used Auto Up to 72 months | 7.25% *APR |

– For other terms and conditions please refer to product information page.

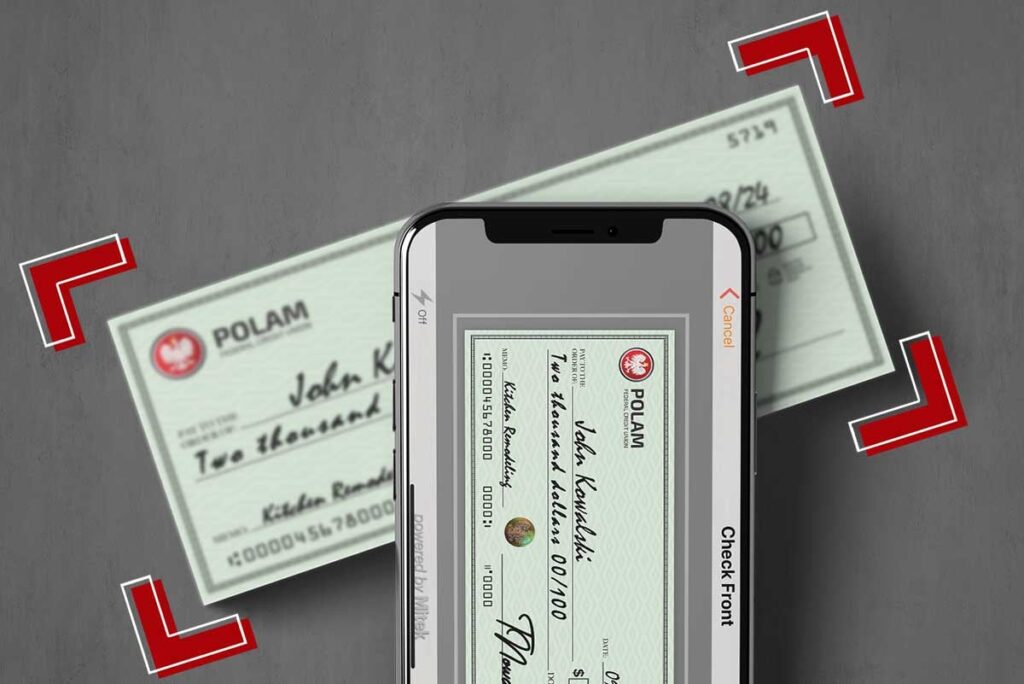

Mobile

Banking

CardValet

Online

Banking

Mobile Wallet

Popular

eServices

News & Articles

- The Many Benefits of Online BankingIt’s 2024, and smartphones and tablets are commonplace among most Americans. That means that everyday citizens have digital access to an entire online world with a device that can fit into one’s pocket. In turn, online and mobile banking has become the norm for anyone who wants to manage their finances without having to visit …

- How to Use Your Home Equity Line of CreditIf you’re a homeowner, you likely already know that you can tap into the equity built into your home and use the funds for a variety of purposes. The longer you own your home, the more equity is earned. Home equity lines of credit (HELOCs) aren’t your traditional loan – they’re reserved for homeowners, and …

- How to Keep Your Loved Ones Safe from Elder AbuseScammers and cybercriminals tend to target the most vulnerable people in our society, and as a large and vulnerable population, senior citizens are a common target for financial scams. Elder abuse in the form of financial exploitation is a sad but common reality, and if you have elderly friends or family members who you worry …